Far East - Europe Container Freight Rates: Outlook to End 2025

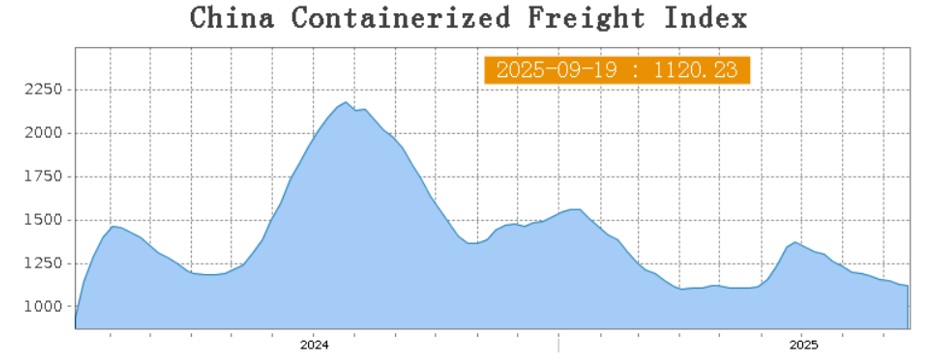

In recent years, geopolitical uncertainties have exerted a significant impact on the global liner shipping market, engendering considerable volatility in freight rates and profoundly reshaping supply chains. It is evident that the rerouting of routes via the Cape of Good Hope, consequent to Houthi attacks in the Red Sea, has engendered considerable capacity constraints on Far East-Europe routes. Nevertheless, as evidenced by the CCFI, despite the ongoing capacity deficit, spot freight rates have exhibited a pronounced decline. (1)

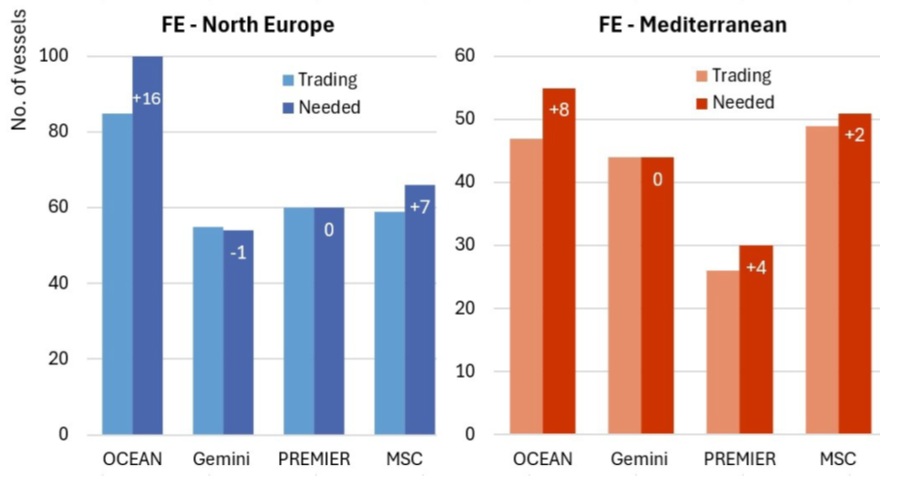

Current Situation: Falling Freight Rates Despite Capacity Shortfall: As demonstrated by Alphaliner data, a total of 461 vessels will be required to operate the 31 Far East-Europe services run by OCEAN Alliance, Gemini Cooperation, Premier Alliance and MSC at full capacity. However, as of 14 September, only 425 vessels were in service. This indicates that a shortage of approximately 36 vessels would theoretically create a gap of 504,000 TEU of capacity that is "not available" in the market.

In the past, this type of supply shortage pushed spot freight rates upwards, but this time the opposite is being observed. Spot freight rates on the Shanghai-Northern Europe route have fallen by 45% over the last ten weeks, dropping to USD 2,300/FEU as of September 2025, which is a significant indicator. This figure stood at 4,100 USD at the beginning of August. Moreover, this decline has accelerated with double-digit drops over the last three weeks, suggesting that a freight rate war is underway in the market.

How Will Fleet Management Be Handled with Alliance Strategies?

Gemini Cooperation: The manner in which fleet management will be conducted using alliance strategies is a subject that merits close examination. The Gemini Cooperation, a joint venture between Maersk and Hapag-Lloyd, has successfully completed the allocation of vessels across all seven Far East–Europe routes. Gemini's 'lean' service model involves a reduction in port calls and an increased reliance on feeder connections. While this strategy does reduce the number of vessels required, it does not entirely eliminate the overall capacity gap.

Premier Alliance. The Premier Alliance, composed of ONE, HMM, and Yang Ming, has achieved full fleet deployment on its Asia–North Europe services. However, some temporary gaps remain, as vessel allocations for the newly launched Far East–Mediterranean MD2 service have yet to be finalised.

MSC and OCEAN Alliance. MSC has been applying a strategy of flexible scheduling, diverting certain ships from eastbound sailings to Indian services. In addition, by converting its “Albatros” and “Dragon” loops into globe-spanning rotations that now include a transatlantic leg, MSC has created temporary imbalances in capacity distribution. Within the OCEAN Alliance, the greatest strain is evident on Evergreen’s CES service. Although the CES loop is designed to operate with 14 vessels, it is currently running with only eight. Evergreen’s newly delivered 15,000+ TEU “M-class” vessels have helped reinforce the service, yet the redelivery of chartered “Thalassa-class” ships has offset much of this gain, leaving the net increase in effective capacity limited.

In considering the factors that have precipitated the decline in freight rates, it is evident that a combination of factors has contributed to the decline in prices despite the capacity shortage.

1. Weak Demand: The phenomenon of diminished economic growth and reduced consumption appetite in European economies has been identified as a key factor in the limitation of cargo demand.

2. Market Competition: The present study investigates the impact of aggressive price competition between MSC and OCEAN Alliance members on the spot market prices.

3. The present study explores the phenomenon of resistance within the context of the Charter Market. Charter rates remain high, and shipowners' strong bargaining position increases carriers' costs, forcing them to keep freight rates low and putting pressure on profitability.

Medium-Term Outlook

It is anticipated that a significant number of blank sailings will occur in the initial period of October, attributable to the Chinese Golden Week holiday. This situation may further reduce capacity in the short term and create upward pressure on freight rates. However, it is important to note that demand is known to weaken further during the winter season. As the factors affecting freight rates on the Far East-Europe route are multi-dimensional, the following headings will be examined to ascertain the market dynamics for the next 6-12 months:

Demand Outlook and Macroeconomic Factors: The weak consumption trends observed in Europe, particularly in major importing countries such as Germany and France, have the potential to suppress import demand, resulting in low cargo volumes. Conversely, expectations of economic recovery in 2026, particularly with the revival of industrial production in Germany, point to a gradual increase in cargo volumes. This recovery is likely to be gradual rather than a sharp "V-shaped" rebound.

Demand Outlook and Macroeconomic Factors: The weak consumption trends observed in Europe, particularly in major importing countries such as Germany and France, have the potential to suppress import demand, resulting in low freight volumes. Conversely, expectations of economic recovery in 2026, particularly with the revival of industrial production in Germany, point to a gradual increase in freight volumes. Consequently, the recovery is more likely to manifest as a gradual uptick rather than a precipitous 'V' shape.

Blank Sailings and Capacity Management: Numerous blank sailings are planned following China's Golden Week holiday (1-8 October). This practice may temporarily reduce capacity and support freight rates. However, once capacity returns to the market after the holiday, prices may resume their downward trend. Major liner operators are expected to continue their "strategic blank sailing" practices in the winter of 2025 and early 2026.

Geopolitical Risks and Alternative Routes: It is anticipated that the Cape of Good Hope route will remain in use until such time as security issues in the Red Sea are fully resolved. Extending the voyage time by an average of 10-12 days is the consequence of this route, meaning that greater capacity is required per vessel. This will create an artificial capacity shortage and will support freight rates. However, should geopolitical risks ease, a return to the Suez route is a possibility, freeing up capacity and putting further downward pressure on freight rates.

Carbon Regulations and ETS Costs: The European Union's Emissions Trading System (EU ETS) will be fully operational by 2026. From this date onwards, ship operators will be required to purchase EUAs for 100% of their greenhouse gas emissions, and it is expected that part of this cost will be passed on to customers. This situation may result in the introduction of additional surcharges (ETS Surcharge) on freight rates, which could hinder the expected decline in freight rates.

To conclude,

The rates for container freight between the Far East and Europe are influenced by a much more complex set of dynamics than the classic supply-and-demand balance. Weakness in demand and price competition between alliances are causing spot freight rates to fall, while high charter rates will squeeze carriers' profit margins. Market volatility is anticipated to persist in the near term; despite a temporary recovery post-Golden Week, freight rates are expected to remain low until approximately 2026 due to heightened capacity and subdued demand. From a strategic standpoint, it is anticipated that carriers will place greater emphasis on cost optimisation, exploring alternative routes such as rail and intermodal solutions, and ensuring compliance with carbon regulations. These developments present both opportunities and risks for importers and exporters. While lower freight costs may offer short-term advantages, the risks to service continuity and vessel availability must be carefully managed in the long term.

Wishing Calm Seas to All Mariners

Sources:

(1) CCFI / https://en.sse.net.cn/indices/ccfinew.jsp

(2) Alphaliner Week 37-25

YAZIYA YORUM KAT

Türkçe karakter kullanılmayan ve büyük harflerle yazılmış yorumlar onaylanmamaktadır.